Singapore Retirement Age 55

On 27 Aug 2018 a research study on retirement in Singapore was released. You have this protection if you.

Young People In Singapore Are Starting To Plan For Retirement Ntuc Income Survey Shows Economy News Top Stories The Straits Times

This means that your employers cannot ask you to retire before that 62 and re-employment must be offered should you wish to continue working up to the age of 67 within the company.

Singapore retirement age 55. Here are two alternative scenarios to consider when planning for retirement. CPF contribution rates will also be raised for workers above the age of 55. The official retirement age in Singapore is 62 and the re-employment age at 67.

Its predicted that Singaporeans could live to the age of 90. Older employees contribution rate to the Central Provident Fund CPF also will increase but the CPFs withdrawal age will remain the same. The official retirement age in Singapore is currently 62.

The increase of Central Provident Fund CPF contribution rates in Singapore for older Singapore workers will also. Dr Tan noted that by 2020 about a quarter of the resident labour force was aged 55 and above up from 165 per cent a decade ago. If you want to retire for 25 years with 2500 a month that will mean.

The official retirement age in Singapore is 62. 2500 x 104 25 years of retirement 13501. This means if you wish to retire earlier say at age 55 you will need to find other sources of income to cover your living expenses.

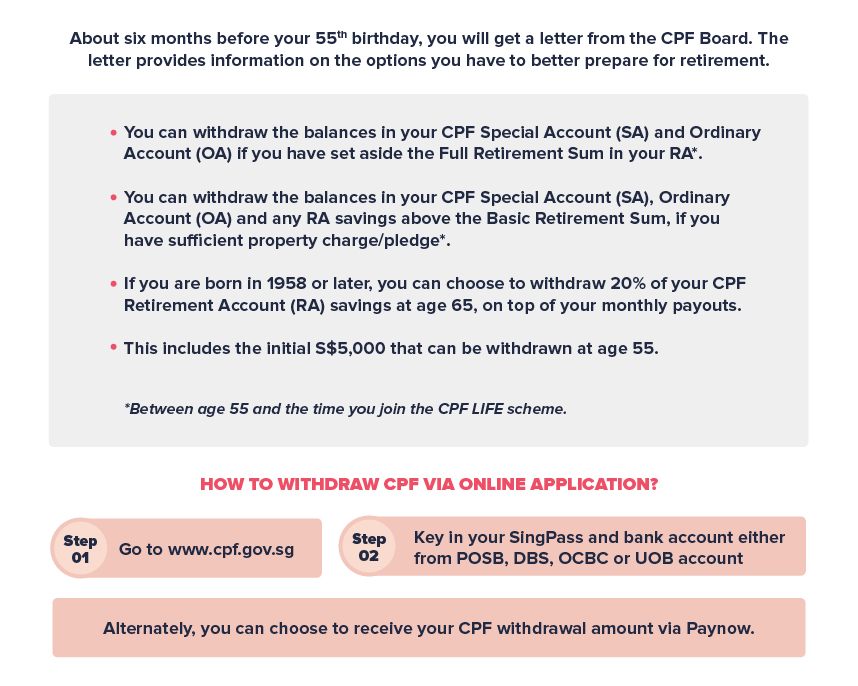

Under this statutory retirement and re-employment age framework employers cannot terminate an employee on grounds of age before the statutory retirement age. Singapore is planning to begin raising its retirement age next year as the city-state seeks to address the manpower challenges of an aging population. A post-55 retirement would mean being able to withdraw excess CPF savings in the Ordinary and Special Account after setting aside your retirement sum in the Retirement Account.

Do note that re-employment is subjected to eligibility. Similarly the re-employment age will increase to 68 in three years time and then to 70 by 2030. Withdrawal at 55 and Payouts at Retirement.

Calculating How Much to Retire Correctly and Safely. SINGAPORE - The retirement and re-employment ages for Singapore workers will be progressively raised to 65 and 70 years old respectively under the. In accordance with the Retirement and Re-employment Act RRA the minimum retirement age is 62 years.

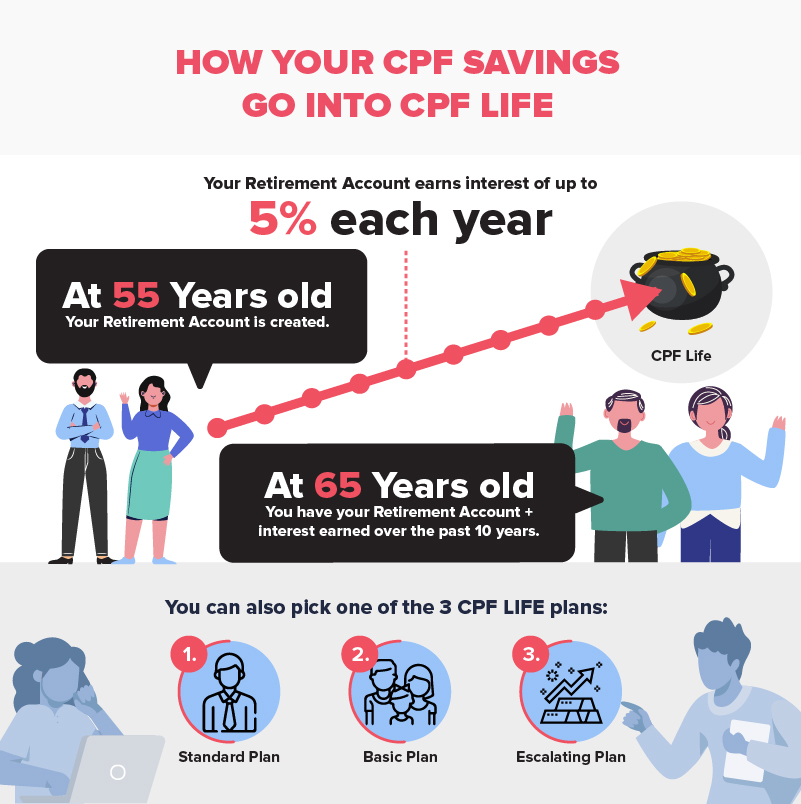

The median income in Singapore is around S4000 a month or S48000 a year. When you reach 55 years old there will be a Retirement Account created for you. As we strive to keep pace with changes in technology we must also expect the nature of the work that we do to change as we get older.

Here are two alternative scenarios to consider when planning for retirementThe official. It surveyed 400 Singaporean parents aged between 30 to 55 years old and there were interesting findings on how the retirement climate in Singapore is like. Retirement Age Our current statutory minimum retirement age is 62 years old.

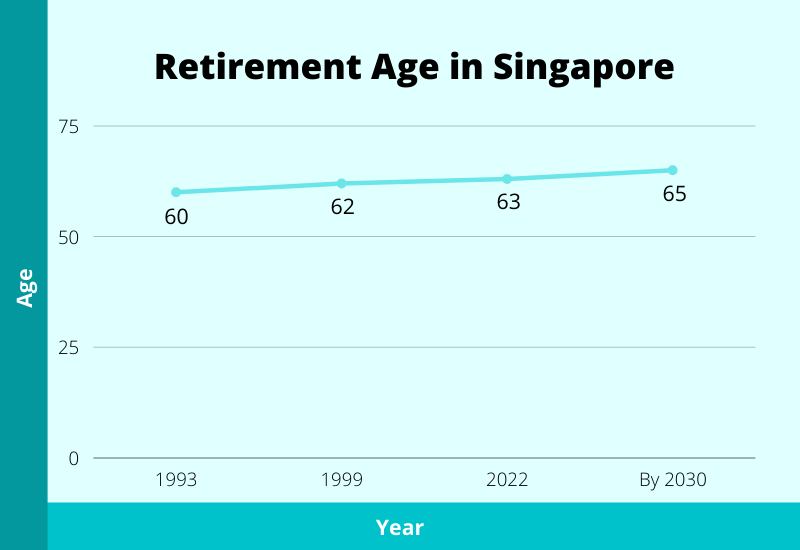

But how much exactly would you need to save and invest to retire at 55. Singapores official retirement age is gradually being raised from the current age of 62 to 65 by 2030. Its better to overestimate your lifespan than.

Manpower Minister Josephine Teo has confirmed that raising the Singaporean retirement age to 63 and the re-employment age to 68 will proceed as planned on July 1 2022. According to the sources the Manpower Minister Tan See Leng said in the Singaporean Parliament that these changes will start on July 1 next year when the retirement age will be raised to 63 and the re-employment age to 68 he added. In 2022 the retirement age in Singapore will be increased to 63 for females and 68 for males.

Therefore an IRR of 70 per cent for most of us would mean S33600 a year after retirement. In Singapore we have a retirement age and a re-employment age. Are a Singapore citizen or Singapore permanent resident.

Joined your employer before you turned 55. Singapores official retirement age is gradually being raised from the current age of 62 to 65 by 2030. Your company cannot ask you to retire before that age.

Work Out the Sum Total Wed Need to Last Till 90. The retirement age will be raised to 63 from 1 July 2022 and gradually. For example retiring before 55 years old would mean most of your income would come from your cash or near-cash instruments like Singapore Savings Bonds or fixed deposits.

If we think long-term we can plan ahead and consider the types of roles that may be more suitable for us as we ageGiven the increase in the minimum statutory Retirement and Re-employment Ages those of us who wish to work longer have greater protections to. The current retirement age is 62. This increase will be done gradually starting in 2022 where the retirement age will increase to 63 and the re-employment age will.

However CPF LIFE payout only commences from age 65 onwards. This means that employers are not allowed to dismiss any employee below age 62 because of the employees age. Singapores normal retirement age will increase to 65 years and the re-employment age to 70 by 2030 the prime minister confirmed in a speech at Singapores National Day Rally.

The retirement age will be raised to 63 from. You can start to withdraw money from CPF when you are 55 years old and you can receive CPF payouts when you are 65 years old. Singapore to introduce retirement and re-employment ages to 65 and 70 years old respectively.

In addition the re-employment age will also be increased from 67 to 70. This means that your employers cannot ask you to retire before that. The official retirement age in Singapore is 62 and the re-employment age at 67.

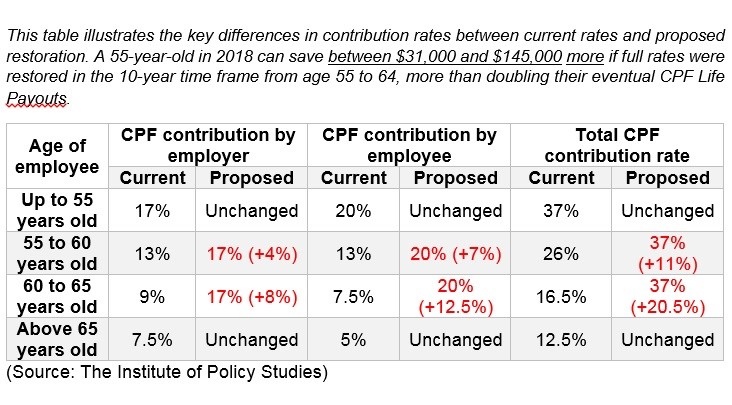

Raising Singaporean Retirement Age CPF Contribution 2022. The retirement age will increase to 63 in 2022 before being raised further to 65 by 2030. Currently the total CPF contribution rate is 37 per cent for workers up to 55.

Prime Minister Lee Hsien Loong announced during his National Day Rally Speech on 18 August 2019 that the statutory retirement age in Singapore will be increased from 62 to 65 by 2030. Take the desired expense you have and multiply that by 104 the 04 refers to a 4 inflation rate to the power of the number of years of retirement.

The Retirement Age In Singapore How It Impacts Us

Many Countries Pushing For Higher Retirement Age The Star

Guide To Re Employment And Retirement In Singapore Singaporelegaladvice Com

Full Restoration Of Cpf Contributions For Those Aged 55 To 60 Higher Rates For Workers Above 60 Hr Guru Singapore

What Happens When You Turn 55 Dbs Singapore

How Much Do I Need To Retire In Singapore And How Do I Build My Retirement Income Stream Moneyowl

Cpf Board Turning 55 This Year Find Out How Much You Could Receive Each Month From Cpf Life Based On The Retirement Sum That You Ve Set Aside In Your Retirement Account

What Is The Correct Age To Retire In Singapore Singsaver

Turning 55 Here S What You Should Consider When Planning Your Cpf Withdrawals

Retirement And Re Employment Ages To Be Raised By 3 Years Cpf Contribution Rates For Older Workers To Go Up Today

How Much Money Can You Withdraw From Your Cpf At 55 Heartland Boy

Preparing For Retirement Tips To Get Yourself Ready Dbs Singapore

Here S Why Most Singaporeans Might Not Be Able To Retire Early

Singapore Case Study For Asia S Aging Workforce Brink Conversations And Insights On Global Business

The Retirement Age In Singapore How It Impacts Us

An Easy To Understand Retirement Checklist Sg 2017

The Case For Restoring Cpf Contribution Rates Of Older Workers